|

|

|

Hawaii Real

Estate Indicators

A QUARTERLY REPORT ON THE REAL ESTATE INDUSTRY

SECOND QUARTER

2025

(inserts from the latest

edition)

|

|

|

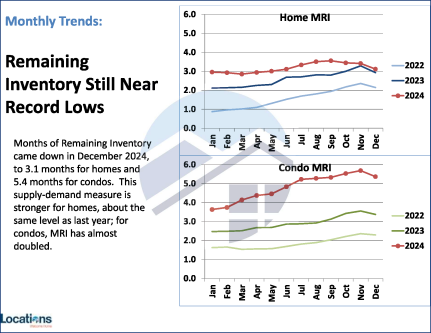

The inventory on Oahu ~ still at low levels thru the 4th quarter of 2024

|

|

crs12.gif)